From the end of April, 2021, VAT in Oman will become a reality. The Sultanate of Oman is the fourth Gulf Cooperation Council (GCC) member state to implement Value Added Tax (VAT), following the footsteps of the United Arab Emirates, the Kingdom of Saudi Arabia, and Bahrain.

The new VAT Law comes into force in Oman following Royal Decree No. 121/2020. It is aligned with the GCC VAT Framework at a standard rate of 5%, with limited zero-ratings. But it also includes the highest number of exemptions that we have seen so far in the region.

How should businesses in Oman prepare themselves?

The tax landscape is rapidly changing now that VAT in Oman is becoming a reality. As a business, you need to start preparing for implementation now by evaluating where you are in terms of readiness, what your teams have done so far, and what resources you have available. If you don’t already have a plan in place to get ready for the change, now is the time to put one together. From TechIntegraERP’s recent research, based on VAT implementation across the GCC and globally, even the most streamlined, efficient and organised enterprises need at least 3 months to prepare.

To add to the pressure, we know that of course your business is facing unprecedented challenges with COVID-19, plunging oil prices, and stuttering markets! But now is not the time to panic. With clear-headed planning, and an experienced, practically-minded advisor behind you, you’ll be navigating these challenges with ease to be ready for VAT compliance from day 1.

How can your business register for VAT in Oman (and should it)?

While not every business will need to be VAT compliant, any business with taxable supplies that exceed the mandatory value threshold of 38,500 Omani Rial (OMR) will need to register for VAT with the Oman Tax Authority (OTA). Businesses that don’t yet meet the value threshold, but expect to eventually do so, are also encouraged to register for VAT in Oman on a voluntary basis. This would particularly apply to start-up businesses with low or no turnover.

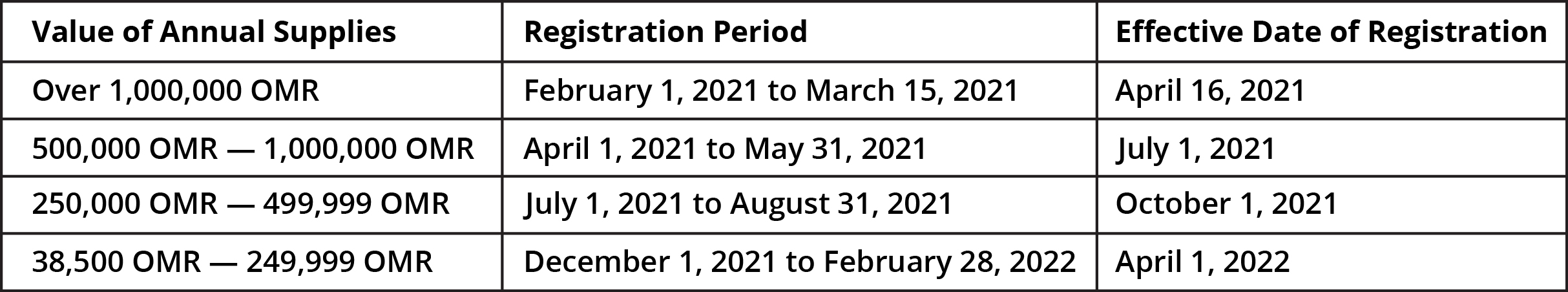

While the initial registration period for businesses with annual supplies exceeding or expected to exceed one million OMR ended on 15 March, 2021, extensions have been offered for businesses in other turnover brackets. Voluntary registration will also be available for business that exceed or expected to exceed 19,250 OMR. You can register through the OTA’s official online portal using the dates set out below:

What does the framework for VAT in Oman look like?

- Certain food items that will be stipulated in a separate ministerial decision;

- Medicines and medical equipment;

- Investment gold, silver and platinum;

- International or intra-GCC transport of goods, passengers and related services;

- Supply of aircraft or vessels designated for rescue and assistance by air or sea;

- Crude oil, oil derivatives and natural gas;

- Export goods and services as well as the re-export of temporary imported goods;

- Supply of air, sea and land transport for commercial passengers and goods;

- And supply goods or services in suspension positions under the GCC unified customs law.

Exemptions and Zero-Ratings

While the reach of VAT in Oman may seem overarching, the country includes the highest number of exemptions from VAT within the GCC region. Companies that specialise in financial services, healthcare and education, bare land, and the renting or resale of residential property won’t have to register or pay for VAT.

Business categories will be exempt from VAT in Oman:

- Financial services

- Preventive and healthcare services and associated goods and services

- Educational services and related goods and services

- The supply of peer land

- Resale of residential buildings

- Local transportation

- Supply of residential buildings by renting

- Importing and exporting of goods, if the final destination country is exempt from VAT or subject to a zero-rate

- Diplomatic international institutions

- Goods and services for military services

- Imports of personal items and gifts carried in travellers’ personal luggage and with foreign people coming to Oman for the first time

- Supplies for non-profitable charitable societies

- Returned imported goods.

While some businesses will be exempt from registering for VAT in Oman altogether, some products will also be provided with a zero-rating, allowing VAT registered businesses to reclaim input VAT expenditure. Zero-ratings will likely apply to:

- Certain food items listed such as:

- Dairy products

- Fruits and vegetables

- Staples such as eggs, water, tea and coffee, sugar, salt, bread, grains, baby food products, fish and meats

- Medicines and medical equipment

- Investment gold, silver and platinum

- International or intra-GCC transport of goods including passengers, plus related services

- Crude oil, oil derivatives and natural gas

- Transport like aircrafts and vessels

- Exports of goods and services

Businesses that specialise in the production of zero-rated supplies and products will likely also be given some relief through the OTA, or may be exempt from registration. They will need to receive prior approval from the OTA, however.

More details on specific exempted and zero-rated transactions and applicable conditions are set out in the Executive Regulations and guidance issued by the OTA.

What are the different types of VAT registration?

Based on the GCC VAT Agreement, there are a few different types of VAT registrations that your business could fall under. These include:

Mandatory registration:

Subject to any transition period or rules set by the GCC, businesses with a taxable annual turnover of 38,500 OMR or 100,000 USD will have to register for VAT in Oman. This registration is mandatory, and will apply for businesses with a past annual turnover that exceeds the threshold, and those expecting to exceed it in the coming year.

Voluntary registration:

Businesses with an annual turnover below the mandatory registration threshold of 38,500 OMR can choose to register voluntarily. This would particularly apply to start-ups who expect to eventually reach the mandatory threshold, and will allow them to reclaim zero-rating VAT expenses. The threshold for voluntary registration is expected to be 19,250 OMR or 50,000 USD.

VAT grouping:

Businesses with multiples entities within a corporate group will have the option of forming a VAT group. This would give them an advantage, as supplies made within the group could fall outside the scope of VAT. In our experience, it is worthwhile to do a feasibility study before forming a tax or VAT group.

Businesses Outside of Oman:

Businesses that produce taxable supplies within Oman, but don’t have headquarters or places of operation within the country will still need to register for VAT in Oman. While there is no minimum registration threshold for such “non-resident persons” in the GCC VAT Agreement, these businesses would need to appoint an agent in Oman. The agent does not have to be jointly and severally liable, nor a fiscal representative of the principal. You can find more details on this in the VAT Law and the Executive Regulations.

Customs duty suspension zones, free zones and special zones:

In our experience in seeing VAT implemented in other countries of the GCC, concessional VAT treatment will likely apply for supplies within, to, and from the customs duty suspension zones, free zones or special zones, and special VAT rules be implemented.

Importers, who are make use of customs duty suspension benefits under the GCC Common Customs Law, would also likely be eligible for similar benefits under VAT in Oman.

How can I make sure that I’m compliant?

Making sure that you comply with VAT in Oman doesn’t end with registration. There are a few other requirements that you’ll need to make sure you follow to remain compliant:

Invoicing requirements:

Businesses or individuals providing any taxable goods or services will have to issue tax invoices. These will need to cover fields like dates, details of transactions, VAT rates and amounts, as well as details of the business issuing the invoice. We expect that English tax invoices will be accepted, together with electronic invoices. The Executive Regulations detail what will be required and specify conditions for simplified tax invoices, as well as cases where businesses are exempt from issuing tax invoices.

Record keeping:

Every registered taxpayer will have to maintain proper records. These include details of tax invoices, customs documents, accounting books, and records of import and export transactions.

Returns filing:

You’ll need to start filing tax returns. Tax periods usually last for 3 months, with due dates for filing the return either the end of the following month or 30 days after the end of the tax period.

Collection/Refund of VAT:

You will have to pay net tax together with your tax return. You can either pay VAT on imported goods on the dates of import, or defer them until you submit your tax return, subject to further conditions.

Transitional provisions:

Since VAT in Oman is still being put in place, there will be a transition period. Rules on how to apply VAT on transactions will straddle the effective dates of VAT implementation.

Penalties:

Where violations occur, or businesses don’t fulfil their VAT obligations, penalties will apply.

The VAT Law sets out the general principles for the application of VAT in Oman in line with the Unified GCC Agreement for Value Added Tax. This was published in the Official Gazette on 18th October 2020 with an effective date for the introduction of VAT in April 2021. Authorities are working around the clock to implement VAT seamlessly across the country. Various initiatives like knowledge sharing guides on VAT, educative and informative sessions, and more are conducted by the OTA to ensure a smooth transition.

With VAT being on the verge of implementation, it is crucial for your business to become tax compliant. As a business owner, you need to be well-prepared with a complete view of your transactions, amount of stock, and value of the supplies. You must be aware of registration timelines in order to stay compliant with VAT laws and avoid penalties. We can help. schedule a free-demo of TechIntegraERP today and find out how a business management software will see you staying VAT compliant in Oman.